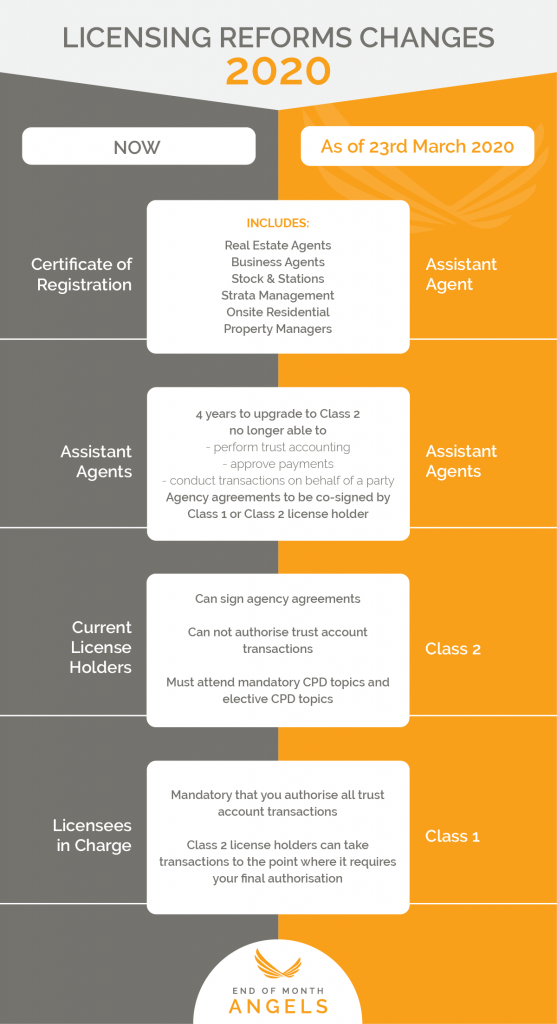

There are certain components of the upcoming Licensing Reforms (23rd March reminder!) that specifically concern Property Managers and Property Manager compliance.

As a quick summary, these points are:

- Current License holders will transition to Class 2 License holders

- Certificate of Registration holders will transition to Assistant Agents

- If you’re currently approving EOM payments, you will not be able to do so after 23rd March 2020

- Assistant Agents cannot transact on the trust account

- All Owners to be disbursed rental funds (less expenses) at the EOM – unless otherwise instructed by the Landlord

- Assistant Agents cannot enter into an Agency Agreement without the signature of Class 2 or Class 1 license holder (Excludes Tenancy Agreements).

Ensuring Property Manager Compliance

In essence, Fair Trading are looking for trust accounts to be as close to $0 as possible at the end of every month. Unless you have written permission from the Owner to withhold funds.

The Reason?

There are always some agents who spoil it for the industry. There are some agents making ad-hoc holdovers and defrauding Owners without their knowledge. Yes, it does unfortunately happen and reforms need to be introduced to stop this, and acts like it, from occurring.

What Do You Need to Do?

This means that you’ll need to:

- Make sure your Licensee in Charge is around at Mid-Month/End of Month. Send them a diary reminder!

- Update Policy & Procedure Manual before 23rd March

- Sign Revoke of Section 31 (Authority to Approve Payments) before 23rd March and hand back token device to Licensee

- Upgrade to a full license within 4 years if you’re transitioning to an Assistant Agent status

- Always get the Owner’s approval in writing to withhold funds for large expenses such as special levies or major repairs

- Always get the Owner’s approval in writing to withhold funds for rates if the tenant pays in advance. For example, if a Tenant pays 6 months, you pay the Owner 5 months’ rent and retain 1 month’s rent for bills. This must be in writing

- Remember, you must only correspond with the Owners that are listed on the agency agreement and to the original email address as per the agency agreement

- Even if the Owner refuses to put this in writing, send them an email to say “Just confirming our conversation today at 12.16pm”…

- If you send communications to the Owner via your cloud software, the digital record will be retained on file indefinitely and cannot be misplaced.

Jane Morgan is the Director of End of Month Angels, a consultancy firm specialising in Trust Accounting. Jane knows the legislative requirements of running a successful Real Estate office through her 23 years’ industry experience. Don’t trust just anyone with your trust accounting. Book an appointment with an End of Month Angel today.